W hat if you have just discover the place to find your own goals, however,, unfortunately, you don’t need to enough of an advance payment to get you to definitely domestic? This is when an enthusiastic 80-10-ten piggyback financial is available in.

Many homeowners genuinely believe that once they don’t possess a massive down fee to possess a home, they cannot acquire one, and in most cases, that is not real. For this reason, we’re going to go over how you can use a great piggyback financial to buy one home you dream about without a great number of upfront money to do so.

What exactly is an enthusiastic 80-10-ten Home loan?

An 80-10-10 financial try good piggyback mortgage. Good piggy straight back home loan is exactly what it feels like. It is one home loan on top of another one. The original mortgage might be noticed the majority of your financial that have a different home loan additionally, which is called a keen 80-10-ten piggyback financial, together with commonly referred to as an additional home loan.

What exactly do brand new Quantity 80-10-10 Show?

- 80 Percent – Here is the matter you to shows new percentage of the new residence’s worth the first home loan covers. Which really worth need to be lower than or equal to 80% to stop the fresh PMI criteria, hence we will mention in the the next.

- ten percent – This is the matter this is the percentage of the brand new home’s purchase rate which is covered via a great piggyback financial.

- 10% – It amount ‘s the sum of money the brand new homebuyer will demand to blow since the downpayment towards domestic. This 10% is not a proper demands and you will doesn’t have to be exact; yet not, here is what many people capitalizing on a keen 80-10-ten mortgage set-out.

Do you know the Benefits of an enthusiastic 80-10-ten Piggyback Mortgage?

Of numerous loan providers want a beneficial 20% down-payment for the domestic we wish to purchase. However, there are other lenders who can approve your property mortgage as opposed to needing to lay 20% off, however they will always require that you pay individual mortgage insurance (PMI). The new PMI was a charge that’s added to your own home loan percentage to guard the lending company if for example the house closes up within the foreclosure or if their worth drops lower than that which you originally borrowed. And therefore leads us to our very own second advantageous asset of which have an excellent piggyback financial.

If you want to prevent having PMI put into the month-to-month home loan repayments on the longevity of the loan, you’ll have to make a down-payment out-of 20% or more. But not, if you don’t have otherwise should not make a beneficial 20% down payment on your own new house, you could end performing this if you take aside an extra financial. The next home loan are able to be taken towards your home’s down percentage, ergo eliminating brand new PMI specifications and you may potentially helping you save tens and thousands of bucks along side longevity of the mortgage.

The huge benefits and you may Cons of obtaining a second Mortgage

There are many benefits and drawbacks that come with the latest prospect of taking right out an additional financial. Hence, we shall split all of them off so you’re able to make use of this pointers and work out an informed choice on even when an additional home loan suits you.

- An 80-10-10 piggyback financial will allow you to get a larger home.

- Another mortgage can assist reduce your monthly mortgage repayments.

- An excellent piggyback financial will allow you to stop using a month-to-month PMI payment at the top of your own month-to-month mortgage payment.

- To qualify for an 80-10-10 financial, you’ll want good credit.

- When using the second home loan https://cashadvanceamerica.net/loans/1-hour-direct-deposit-loans-in-minutes/, you are going to need to pay settlement costs and all of associated charge to your a couple of mortgage loans instead of the one that tend to be pricey.

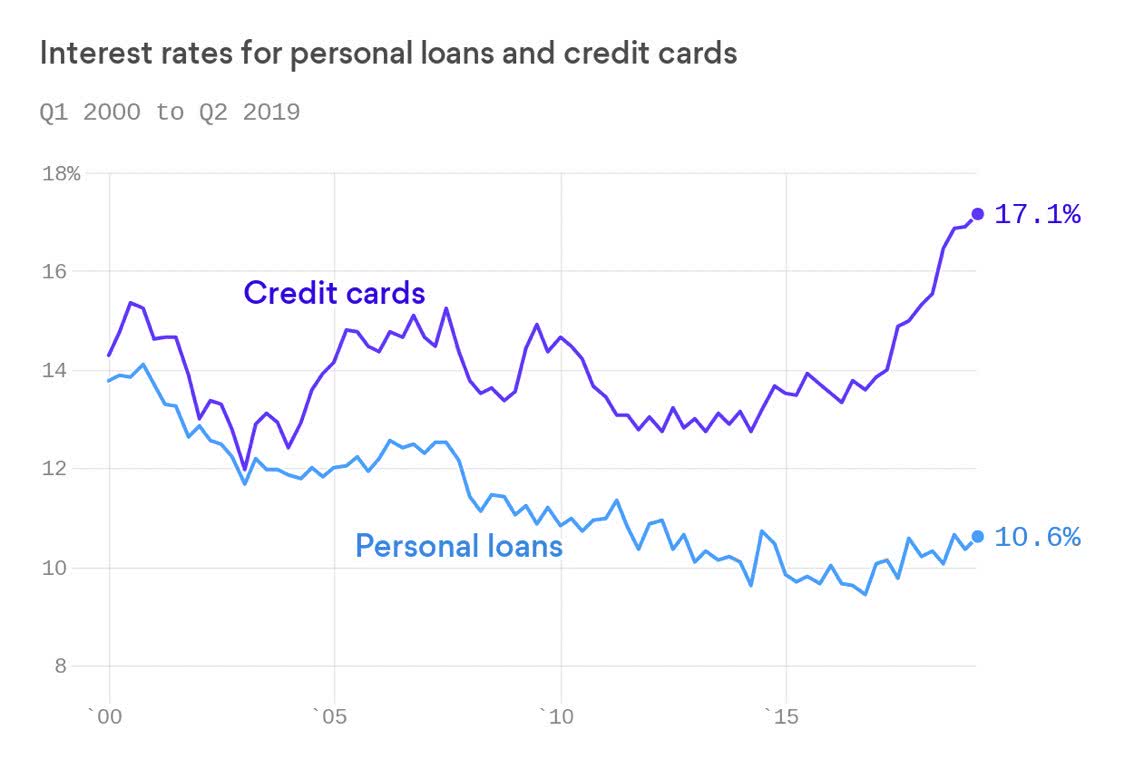

- Another home loan will usually become at a higher interest rate.

- PMI is sometimes tax-deductible; ergo, an effective piggyback home loan you will definitely sooner or later charge a fee more cash since you seems to lose that deduction. In addition, the interest towards the next home loan is also tax-deductible based with the level of the mortgage; thus, if your financial was large, you do not receive the complete taxation work with. But not, we are really not subscribed tax pros so check with your taxation associate to decide in the event that both of them issues certainly are the circumstances to suit your brand of condition prior to one finally decisions.

The bottom line

To shop for a property varies for everyone; for this reason, you should chat to their real estate agent and your home loan financial to choose if the 80-10-10 piggyback mortgage helps make the extremely sense to you plus kind of financial predicament. As the what’s suitable for one homebuyer, might not be suitable for an alternate.