Sign up for your home Loan during the Texas Today!

During the Coverage The united states Financial, we have been happy in order to suffice whoever has served our very own country. I help experts as well as their parents to view reasonable lenders within the Tx, from the Virtual assistant, and also make their dream homes a reality.

Isn’t it time first off your house loan techniques? After that simply fill in brand new short you to definitely-second means less than to begin! We’ll provide a zero-responsibility session so you’re able to guess how much you might be capable use.

Why should I have a good Va-Recognized Mortgage in Texas?

With its outdoor lifestyle, cost of living and delightful terrain it’s wonder as to the reasons many towns and cities when you look at the Texas, such as Denver, had been ranked among the better metropolises to call home, that make it a great condition on the best way to settle down and get your dream domestic. And also by this having a good Va Financing in addition capture advantageous asset of zero PMI or more in order to 0% down-payment. Concurrently, new median sale pricing is $525,000 into the Denver, such. Thus, with this median business speed you are nonetheless underneath the Va Mortgage restriction. VA-Backed Money want 0% down-payment in most cases, while conventional loans basically require at the very least a good step 3% down payment and frequently to 20% requisite. FHA Financing wanted a minimum of step 3.5% downpayment.

Ought i Favor a texas Jumbo Mortgage?

Of several Veterans have already cheated the Va gurus. That have relaxed qualification standards and more independence, its proven to be a good choice for almost all to help you buy and you may re-finance their homes through this system. However, in the most common areas, the newest compliant financing restriction no money off try $548,250. If for example the domestic will set you back more it, the answer is a great Virtual assistant Jumbo Loan. Good Virtual assistant Jumbo Mortgage try any Virtual assistant-Backed Mortgage larger than $548,250. And you will qualifying Veterans can put on to order or re-finance their property for a property value $step one,000,000 through this form of financing, also choosing most of the benefits associated with the general Colorado Virtual assistant Financing.

These are the Trick Masters that Protection The usa could possibly offer your to track down a great Virtual assistant Money into the Texas

1. Va, FHA, and all Financial Products. 2. $0 Advance payment for Va Mortgage brokers. step three. No need to own Personal Financial Insurance. 4petitive appeal rates. 5. All the way down Repayments. six. Better to Qualify. 7. Casual Credit Conditions.

Va Loan Evaluation

Colorado Va Mortgage brokers are money made available to army pros, reservists, and you will effective-duty users on the acquisition of an initial residence. New Experts Government cannot lend currency with the mortgage; alternatively, it pledges the top 25 % of your funds from personal lenders, for example Safeguards The united states Financial, to people that are certified to the Virtual assistant Loan Qualification criteria. Certified veterans can use the financing advantage to pick a house that have zero currency down, no individual financial insurance, and have the sellers pay all of their settlement costs. This type of positives, and additionally very aggressive rates, make Virtual assistant Mortgage brokers inside the Tx the most common mortgage selection for almost all experts.

Va Home loan Costs and you can Will cost you

payday loans Sherman without checking account

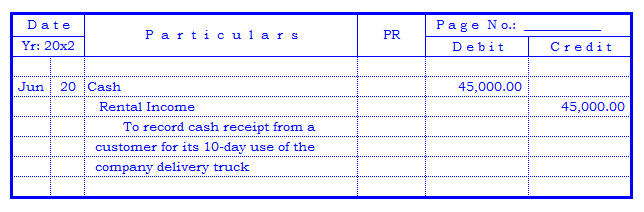

Virtual assistant Money for the Tx have a similar costs associated with closure because the other financial issues, however, there are two main key variations in terms of settlement costs having a Virtual assistant-Recognized Financing. Very first, in the event that negotiated on purchase deal, every settlement costs and you can prepaid service points are going to be reduced of the seller, totaling as much as cuatro percent of one’s purchase price. 2nd, the fresh new Company off Pros Situations fees a good Va Money Payment to the all the mortgage it claims. The fresh Va Resource Fee is actually paid off to the fresh new Va and really helps to buy the house Mortgage Program for all newest and you may upcoming homeowners. So it percentage selections from just one.25 percent to 3.3 percent it is waived for experts which have provider-connected handicaps. Together with, brand new Virtual assistant Financial support Fee is paid-in complete on closure or folded on the financing on closure. Typically, the attention cost to have Va Funds when you look at the Texas is actually lower when versus traditional and you may FHA finance, but you can below are a few all of our Virtual assistant Loan calculator to simply help your influence your payments!