Upcoming Events

As seen in FORBES, Cosmopolitan, Men’s Health, Inside Hook, and Insider Magazine!

6Start Your Adventure Now

At Luxury Lifestyle Vacations you’ll become part of a worldwide family of travelers, risk-takers, and lovers of life. Our exclusive takeovers of adults-only all-inclusive resorts bring dreams into reality for open-minded couples and adventurous singles.

Discover More About LLV

Subscribe to our LLV Newsletter

Subscribe Now!…………

Upcoming Events !

LLV Xperience Cap D’Agde

July 19-26, 2025

SOLD OUT

The best lifestyle location in Agde! A delightful oasis of Lifestyle people and activities.

LLV Portugal Xperience

July 30- August 6, 2025

SOLD OUT

Uncover the sensual side of Portugal with us on our Douro River Cruise!

Desire Cruise- Athens – Rome

September 27 – Oct 4 , 2025

Promising to ignite your senses as you step aboard the elegant Oceania Marina Ship. This cruise is meticulously crafted to offer an unparalleled journey, fusing intimacy and adventure harmoniously.

Bliss Celebrity Reflection 2025

Nov 8 – 15, 2025

Bliss Cruise has put together another great 7-night itinerary to the Eastern Caribbean

LLV Erotic Hideaway 2025

Nov 29 – Dec 6, 2025

Sensual Beats, Erotic Nights, Sexy Moves, Beach Vibes, Love Jacuzzis, Playrooms, Fun Pool Parties, and more!

LLV Egyptian Experience Cruise 2026

January 30-February 8th, 2026

Optional add-on: 4 nights in Jordan (February 8th -12th)

Captivate the Mystique of the Nile, and Immerse yourself in the unique beauty of Egypt.

Bliss Radiance of the Seas

February 23-27, 2026

Get ready to be part of our first ever Sexy Sampler winter cruise and discover what the Bliss experience is all about on the Radiance of the Seas.

LLV Bordeaux Sensual Xperience 2026

July 6-13, 2026

Join us and Fall in love with unquestionably one of France most beautiful city!

LLV Sensual Voyage

October 2-9, 2026

A sensual and uninhibited journey from Montreal to Boston

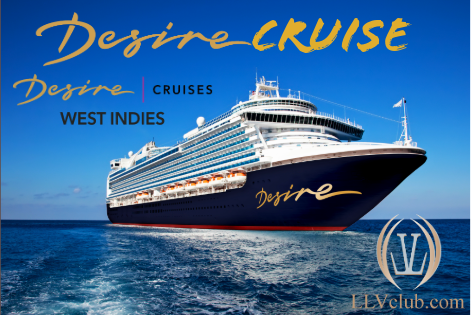

Desire Cruise- West Indies 2026

February 15-22, 2026

Aboard the Oceania Insignia, the first of its kind to be held in America, where the allure of the Caribbean converges with the passion of your desires.

Bliss Celebrity Silhouette 2026

April 26 – May 2, 2026

There is never a dull moment on Bliss Cruise. The party begins the moment you step on the Celebrity Silhouette for this six-night sailing to the western Caribbean.

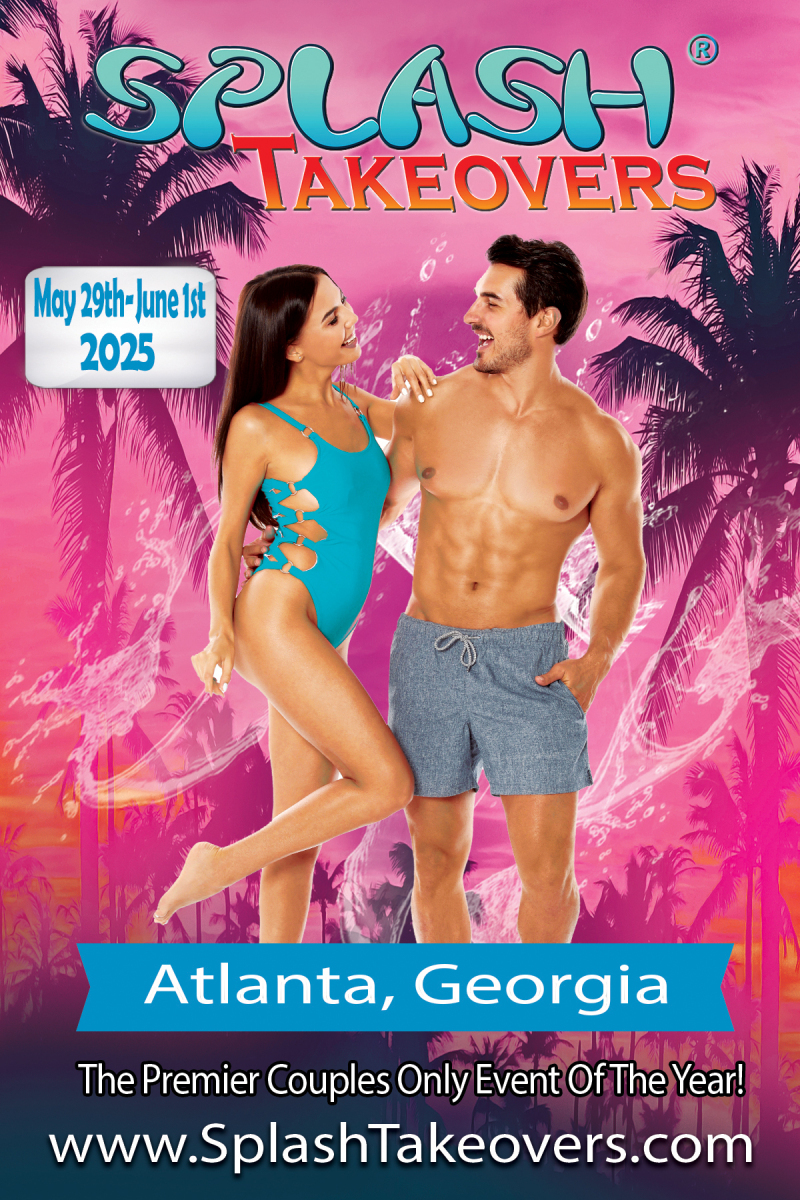

SPLASH Takeover- Atlanta Georgia

May 29- June 1st , 2025

Splash Takeovers offers a full range of activities day and night for sexually adventurous couples! Take advantage of our Daily Seminars, Interactive Activities, & Adult Marketplace

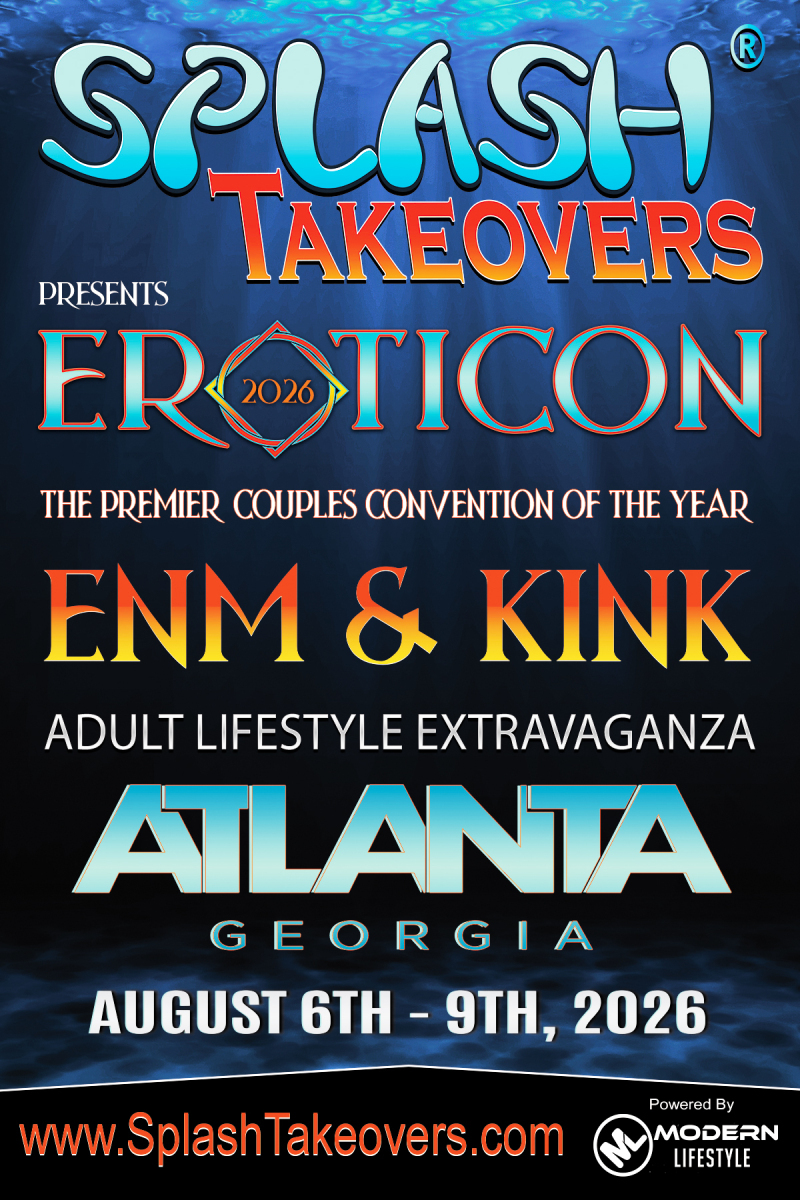

SPLASH Takeovers Presents EROTICON 2026

Aug 6-9, 2026

Splash Takeovers offers a full range of activities day and night for sexually adventurous couples! Take advantage of our Daily Seminars, Interactive Activities, & Adult Marketplace

Bliss Wonder of the Seas 2026

November 9 – 16, 2026

Apparently, size does matter!! Sailing on the Wonder of the Seas for our November 2026 cruise, starting in sunny Miami, Florida, and sailing to Oranjestad, Aruba & Willemstad, Curacao.

LLV Tahiti – Fiji Cruise 2027

April 26- May 8, 2027

From Tahiti to the Fiji Islands, onboard the ultimate in luxury, opulence, and adventure…

Bliss Celebrity Summit 2027

February 24 – 28, 2027

Enjoy the wonders of the Caribbean on the Celebrity Summit departing from Tampa, Florida in February 2027. You’ll have sea days packed with daytime pool activities, seminars and workshops, meet & greets, clothing-optional pool and open deck areas, plus, afternoon playtime fun.

Bliss Celebrity Silhouette 2027

April 18 – 24, 2027

Six nights full of energy sailing features a new Bliss destination: Cabo Rojo, a beautiful and exotic port in the Dominican Republic

LLV

Events

We make dreams a reality. Indulge your senses, find your limits and keep coming back for more.

Hotels (All Year

Booking)

Unwind in posh accommodations and luxurious amenities designed to lift your spirits and libido.

Hotel

Events

Be yourself, without judgment or restrictions, at our diverse, adults only exclusive events.

Our Client’s Words

Incredible Experiences Await You

A vacation with Luxury Lifestyle Vacations gives you the chance to expand your global, social and sexual horizons. Our all inclusive adults only trips include everything an open-minded couple or sexy single could need. We take care of every detail from posh rooms, adventurous excursions, world-class entertainment and lavishly-produced theme nights to erotic playrooms, informative seminars, fine dining and private beaches. You’ll revel in the incredible hospitality and attention to detail. Years of experience traveling around the world and attending to our guests’ needs allows us to continually adapt and perfect your experience. That’s why our travelers have been coming back, year after year, to travel with us. It’s the art of relaxation mixed with fantasy and fun!

At LLV, we don’t just think of you as just a client. By the end of your trip, you’ll leave as a friend.

....

Our Partners

Open your mind, free your soul

LLV CLUB

Step into every ounce of curiosity, tempt your desires and indulge the lifestyle you crave. Make your dreams reality, and indulge in the finest lavish this community has to offer. Open your mind, free your soul, explore the world. Travel with Luxury and Experience a life you’ve always yearned of.

Discover Your New Beginning

Explore the world

Travel, Liberated

Exclusive, unique surroundings

Uniquely created environments and exclusive resort takeovers create a one-of-a-kind experience.

Exotic, extraordinary destinations

Hot beaches, gorgeous locales and alluring travelers for your most erotic journey.

Our Blog

Tips and information for the open-minded adults and swingers community.

Spicy Ibiza

Our exclusive takeover of ME Ibiza transforms it into a clothing-optional pleasure zone filled with open-minded couples and singles wanting to share unbridled fun!...

Puerto Vallarta

Unique playrooms, daily pool parties and a private beach are just a small part of our exclusive takeover of the 5-star Barceló Puerto Vallarta....

Alaskan Splendor Cruise

Alaska, it’s the place you’ve always dreamed of. Where the ordinary is simply extraordinary and the views, like your memories, go on forever. Alaska...

Annual Winter Getaway

Clothing optional, kinky fun in Jamaica to wipe away the winter “blahs.” Experienced lifestylers and curious newcomers receive first-class treatment on an all-inclusive trip...

Annual Desire Takeover

Wild nights abound on this spectacular, exclusive takeover of the luxurious, newly-renovated Desire Resort and Spa. Sexy, open-minded couples fulfill their desires at the...

Bliss April Cruise

When the weather warms up, inhibitions go down. Packed with almost 2,000 sexy couples, you’ll make new friends open to testing boundaries at one...

Into Temptations

Our younger crowds love this complete, all-inclusive tower takeover of the Temptation Resort & Spa for flirty fun, topless parties and exclusive meet and...

River of Passion

Luxuriously cruise along the Danube with sophisticated couples in this exclusive LLV cruise takeover. Five-star service, upscale dining, exquisite suites and a unique travel...