That is a game changer: Foundation try providing the customers an industry-leading mortgage repair sense. With the launch of our the brand new during the-house maintenance program, clients can with ease would their financial membership when, anyplace. All of Colorado title loan our most readily useful-level tech platform allows people fit everything in regarding checking escrow hobby and you can scheduling payments to help you strategizing loan payoffs and you can being able to access associated resources, in addition to disaster rescue pointers. Most importantly, subscribers remain capable delight in custom solution and assistance from our caring associates.

HOUSTON, Foundation House Financing, among the many nation’s prominent home-based mortgage businesses, introduced its complete provider, in-house mortgage maintenance process for new loan originations, merging the 34-year community from superior customer care with world-best loan upkeep technologies.

Foundation has made tall opportunities to build a top-notch people regarding repair gurus added by Toby Wells, Cornerstone’s Dealing with Movie director of Loan Repair

Providing a remarkable consumer sense remains among Cornerstone’s secret Key Convictions since the all of our beginning 34 years back, and we also is thrilled provide all of our mortgage maintenance users a comparable level of brilliance who may have enough time outlined Cornerstone’s mortgage origination operations. The compassionate hearts, service-driven people, enterprising soul, and you will intimate commitment to excellence lay Cornerstone apart, with in users to optimize customer care. Fulfilling all of our business obligations to add a remarkable buyers experience in the loan maintenance mode means Cornerstone when planning on taking full control and every single day power over the entire servicing process. Foundation people will stay in the advanced proper care of Foundation people participants in the mortgage origination and you may closing techniques, now through the entire lifetime of its financing, said Adam Laird, President out of Cornerstone.

Foundation may also transition its current real estate loan servicing profile in order to the company’s from inside the-house system in the upcoming weeks. Cornerstone’s robust maintenance program supporting and you can streamlines all aspects off Cornerstone’s mortgage repair functions of loan boarding so you can benefits, enabling all of us users to target what truly matters most: an extraordinary buyers experience. Cornerstone’s faithful financing repair class have a tendency to constantly elevate every aspect of the loan repair technique to increase the club to own customer happiness, told you Toby Wells.

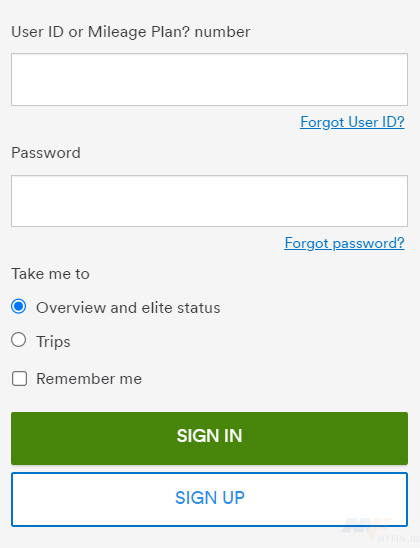

Customers are offered a package off online units in order to easily access and would the financial membership when, anyplace. Cornerstone’s member-friendly loan servicing webpages and you may mobile application offer prompt guidance, eg charging comments, escrow interest, and you can multiple commission alternatives and you can rewards calculators. Self-services possibilities permit Foundation consumers to help you quickly register to possess properties eg because autopay, biweekly repayments, and you may paperless statements. Customers may also content with Cornerstone team members and accessibility of use informative tips, emergency recommendations, and.

On top of that, Cornerstone’s servicing platform optimizes state-of-the-art interior techniques, such as for instance supervision and monitoring of escrow and you will tax activity, to allow proactive handling of customers’ escrow membership. Extensive cross-system analytics bring actionable notion to assist improve process, create and reduce chance, and you will hone the customer experience. Cornerstone continues to roll out new financing servicing has actually and you may options for people because grows its into the-household repair procedures.

Your selection of Black colored Knight’s cutting-line maintenance technology platform, and additionally compassionate and you may highly trained Foundation associates, creates a premier-of-category mortgage servicing feel to have Cornerstone people for the life of its mortgage

From the Foundation Household Credit (Business NMLS 2258)Dependent for the 1988 in Houston, Colorado, Foundation has aided household with well over 450,000 home financing deals. Cornerstone’s step 1,900 team members are directed by a non-negotiable Purpose, Attention & Beliefs statement. Cornerstone is renowned for its dedication to closure mortgage loans toward time; their compassionate, passionate and knowledgeable team members; complete selection of imaginative financial financial loans and attributes; authoritative Good place to your workplace condition, multiple Finest Practices prizes and you can detection while the a great Ideal Workplace inside the multiple significant locations. To learn more, visit houseloan.

We professionals is actually 100% serious about deciding to make the financial techniques as easy that one can. Which commitment runs outside of the closing table. We are very happy to provide our very own members more control, self-reliance, and openness in managing the complete lifecycle of the home loan.