Save money fundamentally

Owning a home function preserving more money through the years. Oftentimes, the cost of a monthly mortgage payment can be lower than the cost of a rental percentage. It’s not necessary to lease most storage or struggle to have parking in your home, either.

You will never have to deal with increased rent costs, too. A property manager can ratchet right up local rental costs if they should. But with a mortgage, you will have a clearer feeling of your financial image on months in the future.

Get Taxation Deductions

You’ll have to pay taxes once you scholar into the actual globe and you can home work. A life threatening advantage of home ownership are deducting home loan attract whenever filling out your returns.

On your first 12 months out-of homeownership, you may also be able to subtract servings of one’s closing will cost you. Please claim origination charges, that are found in settlement costs. And also for yet another work for, you could deduct your property taxation.

When aspiring to pick property, you will want to begin by an obvious funds. Check your month-to-month salary and create a network to optimize savings. Whether you are graduating out of a neighborhood university otherwise one in a good additional condition, a number of the concepts of shopping for property are identical anywhere you adore. Many move in immediately after school, therefore you should pick an effective spot to live.

Hammer Out a resources

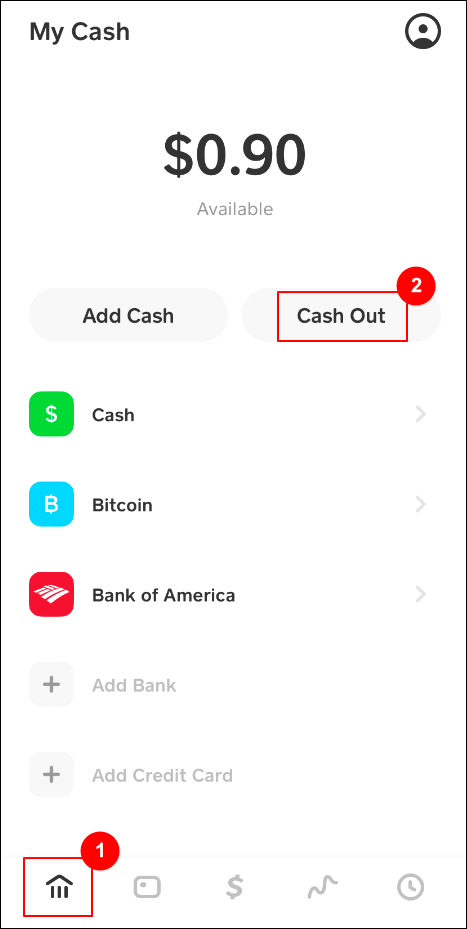

Believe a budget means in search of an approach to live within your mode. Consider using an app or spreadsheet to track your expenses for each and every loans Cos Cob CT few days. Account fully for resources, lease or mortgage payments, subscription charges, wire, student loans, and much more.

Try to maximum 29% of your revenues to construction can cost you. To put it differently, while you are ingesting $step 3,000 off really works 30 days, keep your book otherwise mortgage significantly less than $step one,000 four weeks.

Take the appropriate steps to put Profit Savings

While fresh off university, managing family relations or a roomie for a time may be advantageous to establish offers. You might pouch a lot more of your paycheck once you lack to blow book otherwise home financing.

You don’t have to generate ramen their wade-in order to buffet, but be frugal. Restrict your paying for dinner, films, or any other low-extremely important affairs.

Ask Family having Help

The new deposit can be the greatest difficulty whenever a recently available college or university graduate shopping property. You may have below tens and thousands of cash within the your own family savings. And also you won’t have profited regarding income regarding a previous domestic.

Think looking at your family for help with a down-payment. Your mother and father could be prepared to leave you currency. For many who wade that it station, you’ll want to run your financial to confirm a few something earliest.

Their lender will need proof of the partnership. They will in addition need a present letter confirming the parents’ intention so you can give you the currency. At the same time, their bank may prefer to find good banknote or any other signal of your own money’s resource.

7. Comprehend the Part of the Credit score

When you decide to follow homeownership, you should have an easier day having a far greater credit score. Loan providers will look at the credit score when they determine an effective loan amount. It is possible to improve your get beforehand talking having loan providers.

What’s a credit history?

A credit rating selections off 300 so you can 850, providing someone a sense of the creditworthiness. The higher the quantity, the higher brand new rating.

A credit score spends an algorithm you to takes into account details just like your vehicle, mastercard, or education loan obligations. It will cause of expenses costs, unlock account, and available borrowing from the bank.