A great. Down Rates: Among the many advantages of finalized-end credit security ‘s the potential for down interest rates. Because of the pledging valuable property because equity, individuals is safe fund at a great deal more advantageous conditions. Loan providers be much more prepared to bring smaller rates of interest when they enjoys guarantee so you’re able to right back the loan, as it reduces the chance.

B. Use of Big Loans: Collateral can permit individuals to view large mortgage amounts than it would typically qualify for predicated on its credit history otherwise money. By way of example, a single having an invaluable bit of home may use it collateral so you’re able to safer a hefty home loan.

B. Exposure towards Lender: While you are equity mitigates exposure to the financial, it will not eliminate it totally

C. Enhanced Approval Potential: Collateral-backed fund often have highest acceptance costs, therefore it is a nice-looking option for individuals with less-than-stellar credit. The newest equity mitigates online personal loans OR a few of the lender’s issues, raising the odds of mortgage recognition.

A beneficial. Investment Forfeiture: More visible danger of closed-stop borrowing security ‘s the possible death of new sworn property. If for example the debtor non-payments to the loan, the lender can also be grab the latest guarantee, which is property, vehicles, or any other worthwhile products. Which exposure have really serious effects, eg shedding an individual’s no. 1 home.

In the event the property value brand new guarantee depreciates over the years, may possibly not security the newest an excellent mortgage equilibrium even though out of a standard. Lenders must gauge the high quality and marketability of your own security faithfully.

C. Smaller Liberty: Closed-avoid borrowing equity can also be limit the borrower’s capacity to use the collateralized investment with other purposes. By way of example, a property utilized as the guarantee can not be easily marketed or refinanced with no lender’s agree, restricting the borrower’s financial independence.

A good. Mortgages: Perhaps the most common exemplory instance of signed-stop borrowing guarantee is actually a mortgage. Homeowners promise new ordered assets since guarantee, of course, if it fail to build payments, the financial institution is also foreclose into the household.

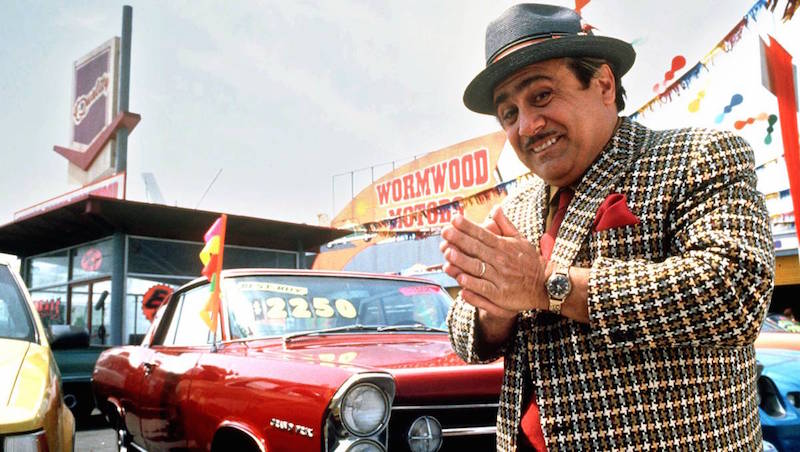

B. Automotive loans: When resource the purchase out of a vehicle, the automobile by itself tend to functions as collateral. In case the debtor non-payments towards car finance, the lender is also repossess the auto.

Closed-end borrowing from the bank security also offers a selection of positives, together with straight down interest rates, big financing number, and you can increased acceptance opportunity. However, it includes extreme risks, including the potential loss of valuable property and shorter independency. Understanding the nuances out-of finalized-stop borrowing from the bank collateral is essential for individuals and loan providers and work out informed financial decisions.

Regarding securing a loan otherwise borrowing from the bank, guarantee takes on a pivotal role from the picture. Guarantee serves as a back-up to own loan providers, providing them a kind of warranty that the borrowed financing will getting paid off. not, to own borrowers, it’s imperative to comprehend the true value of the guarantee they bring. Within our ongoing exploration out of closed-end borrowing from the bank equity, let us look into the whole process of comparing the value of collateral. It isn’t just about the brand new product’s price; it’s an excellent nuanced testing that takes into account individuals facts.

C. Secured loans: Specific signature loans try shielded by the assets such as discounts levels otherwise certificates of put (CDs)

step 1. Market price vs. Appraised Worthy of: One of the first considerations whenever comparing security is whether your should use the market price or an appraised well worth. Market price is exactly what a product you will sell for on the open-market now, while appraised worth is a specialist estimate out of a keen item’s really worth. Eg, when it comes to a residential property, an appraiser tend to gauge the possessions and supply a respect one to considers the standing and you may venue. Loan providers often prefer appraised really worth for an even more right imagine.